Car Loans for Casual and Part Time Workers Rapid Finance

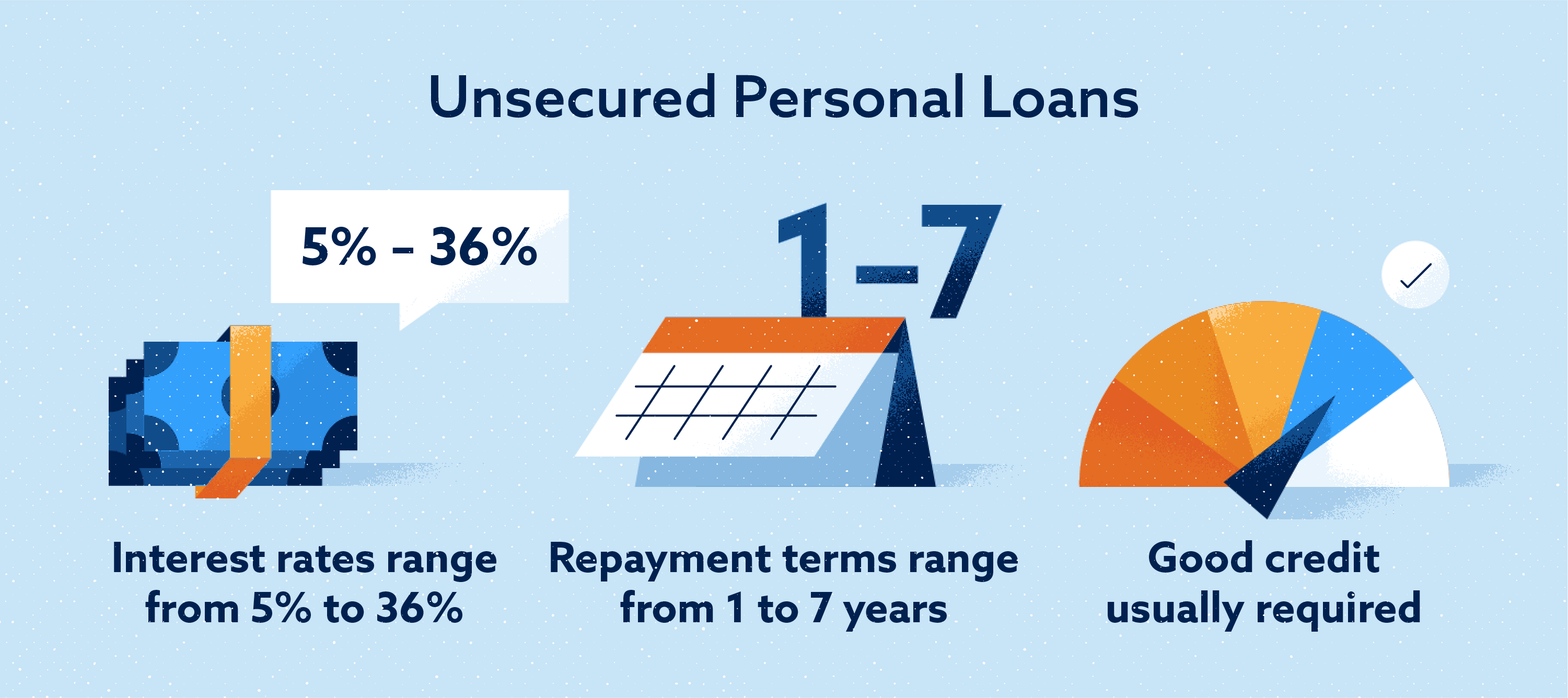

A Salary Finance loan is an unsecured personal loan that should be used solely for personal, family, or household purposes. Most of our borrowers take out their loan to pay down existing, higher-cost debt, like credit cards, payday loans, or medical bills. Your Salary Finance loan cannot be used for expenses like real estate, business purposes.

PERSONAL LOAN Money With Bank Employees Approve Contract Stock Image Image of coffee, concept

Loans for casual and part-time workers Casual and part-time workers can take out a personal loan. It really helps to show proof of regular income and regular savings. The better your credit score, the better your odds of approval. By Rebecca Pike Reviewed by Richard Whitten Updated Oct 11, 2023 Fact checked Refine results Share my filters

Can You Get A Home Loan With A Casual Job Job Drop

Personal loans for casual and part time workers If you're a casual or part-time employee, you can still secure a personal loan. But there are a few things you should know first. Harry O'Sullivan Graduate Finance Journalist Fact Checked Rates updated 9 hours ago Loan duration Loan amount Update results Compare Rates Features Fees Other

Employee Loans CreditWise

Compare your loan options: After prequalifying, compare the preliminary loan offers. Look at the APR, repayment period and any fees, including origination fees and early repayment penalties.

A Complete Guide To CollateralFree Business Loans APN News

Home Loans For Casual Workers - If you are looking for lower monthly payments then our convenient service is a great way to do that.

6 Types of Personal Loans (and How They Can Help You)

Workers Welcome to Financial Freedom with Loans for Workers Explore the convenience and ease of our Loans for Workers. We offer low-cost loans designed with you in mind. Borrow responsibly and enhance your financial wellness. No high-interest rates, no stress - only a sensible way towards a financially secure future. Offers: 6 By date Updated:

How Does an Installment Loan Work Exactly?

The most common type of home loan for casual workers is a low doc home loan, which is a mortgage that is designed for the self-employed or those who receives an irregular income, rather than a consistent PAYG income. These types of loans are considered to be riskier than a regular home loan, so they often charge slightly higher interest rates.

Building Your Credit Profile With A Personal Loan Finance Sesame

Home Loan Casual Employment You might be eligible for a home loan today 60% Market average loan approval rate 97% our loan Approval rate 1217 5 star Reviews on google Are you ready to buy a home but have been knocked back by your bank because you are in casual employment? Don't worry!

Getting a Home Loan for Casual Workers Your Mortgage

Compare Reviews of the Best Business Loans. Get Fast Funding with Low Rates!

Home loans for casual workers

Loan amounts range from $1,000 to $40,000 and loan term lengths range from 24 months to 60 months. Some amounts, rates, and term lengths may be unavailable in certain states. For Personal Loans.

How They Work Personal Loans YouTube

Mar 2, 2023 Fact checked If you work part time and want to apply for a loan, the process can be a little more complicated than it would be for your full-time coworkers. That's because lenders have to work harder to verify your ability to repay a loan.

Documents Required for Personal Loans for Salaried and Self Employed

Getty. The personal loan amount you can qualify for is typically determined by your credit score, income, debt-to-income ratio and other factors. Although loan amounts vary across lenders, the.

How Does A Personal Loan Work? Loans 101 YouTube

What is GovLoans.gov? GovLoans.gov is an online resource to help you find government loans you may be eligible for. It is not an application for benefits and will not send you free money.

Can Casual Construction Workers Get a Home loan? The Dragon Group

Ask your employee why they need the loan. Borrowing money for a one-time unexpected or emergency expense is one thing, but constant overspending and living without a budget may lead to a long road of being pestered to borrow more money. 2. Set Expectations. Formalize your lending arrangements to protect your business.

.png)

An overview of the main casual worker agreements

Before you borrow, learn what you need to get a loan as a casual or part-time worker. Personal loans are accessible to casual and part-time workers in Australia. With the right lender, proper documentation, and financial responsibility, you can secure a loan that helps you achieve your financial goals.

The 7 Types of Business Loans Available on the Market Today Debthunch

NerdWallet's Fast Personal Loans: Best Lenders for Quick Cash in 2024. SoFi Personal Loan: Best for Same-day approval, same-day funding. LightStream: Best for Same-day approval, same-day funding.